Unlock Your Financial Freedom with Endependence.

We help Americans

end dependence on their 9-5 paychecks by creating retirement income plans that focus on preservation of principal, tax optimization and guaranteed streams of income.

As Seen in Kiplinger:

Tyler Jones, WMCP

Three Ways to Create a Stronger Income Plan for Retirement

Michael Miller

Three Strategies to Cut Your Taxes in Retirement

The appearances in Kiplinger were obtained through a PR program. The columnist received assistance from a public relations firm in preparing this piece for submission to Kiplinger.com. Kiplinger was not compensated in any way.

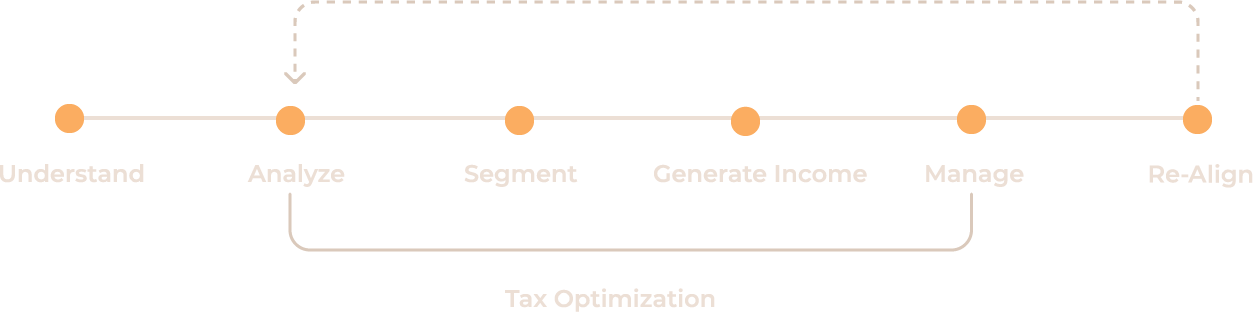

The 7 Steps to End Dependence

-

Understand

-

Analyze

-

Segment

-

Generate Income

-

Manage

-

Tax Optimization

-

Review & Realign

Here to offer heartfelt financial guidance you can trust.

You are more than a client to us. You are a real person with a story and that is how we see you. We build deep and lasting relationships because we know that, to you, this is so much more than dealing with money.

What you can expect

Inquire

Reach out to our team to express your interest in learning more about how we can assist with your retirement planning needs.

Schedule a Visit

Book a consultation, either virtually or in person, to discuss your financial situation and retirement goals in detail.

The 7 Steps to End Dependence

Engage with our planning process, designed to create a tailored strategy that aims to help secure your financial independence.

What you can expect

Inquire

Reach out to our team to express your interest in learning more about how we can assist with your retirement planning needs.

Schedule a Visit

Book a consultation, either virtually or in person, to discuss your financial situation and retirement goals in detail.

The 7 Steps to End DependenceTM

Engage with our planning process, designed to create a tailored strategy that aims to secure your financial independence.

Questions people ask

ANSWER

In our opinion, an independent financial practice operates autonomously, offering unbiased and personalized financial planning and investment advice that focuses on the client’s retirement goals and objectives, without the influence of external corporate entities.

ANSWER

We offer comprehensive retirement planning services including analysis and management of investments, tax optimization strategies and a custom-tailored approach to meeting your retirement goals through our 7 Steps to End Dependence™ process.

ANSWER

We accommodate our clients’ preferences and schedules by offering both virtual and in-person consultations, helping create convenience and personalization in every interaction.

Did we miss something? Ask us a question

Wondering How to Create Income in Retirement?

A Trusted Financial Professional Can Help You Explore Options

Do you believe these 5 annuity myths?

In this guide, we address common misconceptions about annuities to help you decide if an annuity might be right for you, including:

- Annuities make accessing money impossible.

- Annuities are too complicated to understand.

- Savings are enough — why an annuity?