Helping you end financial dependence.

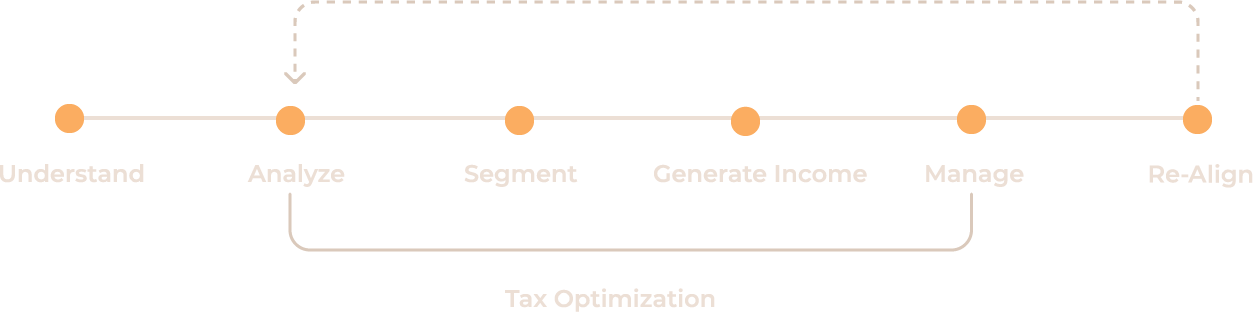

The 7 Steps to End Dependence

-

Understand

-

Analyze

-

Segment

-

Generate Income

-

Manage

-

Tax Optimization

-

Review & Realign

Questions people ask

ANSWER

In our opinion, an independent financial practice operates autonomously, offering unbiased and personalized financial planning and investment advice that focuses on the client’s retirement goals and objectives, without the influence of external corporate entities.

ANSWER

We offer comprehensive retirement planning services including analysis and management of investments, tax optimization strategies and a custom-tailored approach to meeting your retirement goals through our 7 Steps to End Dependence™ process.

ANSWER

We accommodate our clients’ preferences and schedules by offering both virtual and in-person consultations, helping create convenience and personalization in every interaction.

Did we miss something? Ask us a question

Grow Your Income

Retirement Income Strategies

Grow Your Income

Wealth

Management

Grow Your Income

Annuities

Grow Your Income

Investments

Grow Your Income

IRA/401(k)

Rollovers

Preserve Your Assets

Asset Preservation Strategies

Preserve Your Assets

Life Insurance

Preserve Your Assets

Tax-Efficient

Strategies

Pass It On

IRA Legacy

Planning

Preserve Your Assets

Long-Term Care Strategies

We can also refer you to professionals who provide the following services:

Trusts Probate Charitable Giving Estate Planning Tax Planning

Insurance products are offered through the insurance business Endependence Financial. Endependence Financial is also an Investment Advisory practice that offers products and services through AE Wealth Management, LLC (AEWM), a Registered Investment Adviser. AEWM does not offer insurance products. The insurance products offered by Endependence Financial are not subject to Investment Adviser requirements.

Neither the firm nor its agents or representatives may give tax or legal advice. Individuals should consult with a qualified professional for guidance before making any purchasing decisions. Investing involves risk, including the potential loss of principal. Endependence Financial is not affiliated with or endorsed by the U.S. Government or any governmental agency.

Our team is accepting new clients.

We would love to hear from you.